So, you’re considering investing in stocks, cryptocurrencies, or something similar, but don’t know where to start? There are tons of apps out there that can help. Whether you’re planning to invest a little or a lot, there’s an app that can work for you.

These apps are not only great for trading, but they can also help you learn more about different companies and investment opportunities so you can make informed decisions before spending a penny.

Now, you might wonder, which app is the best for beginners? Well, several great options are available for both Android and iPhone users. Whether you’re rocking a Google Pixel 8 or an iPhone 15 Pro, you’ll be able to find an app that works for you.

Related

- The 10 best apps for a second phone number in 2024

- The 5 best smart notebooks for 2024

Sponsored

You can invest in under 10 minutes with Robinhood [Sponsored]

If you’re looking for more great financial apps, see our picks for the best cryptocurrency apps and best stock-trading apps.

Stash

Stash is an innovative mobile application that simplifies investing in stocks, bonds, and exchange-traded funds (ETFs). With Stash, you can start investing with as little as $5 and even purchase fractional shares. This means that no minimum investment is required to get started.

One of the most exciting features of Stash is the Stock-Back Card. This unique feature provides rewards on everyday spending that can be used to invest in your portfolio. You can earn money while spending and then invest it in your portfolio. This card makes it easy to build your portfolio passively without making any additional investments.

Stash also offers a variety of tools and resources to help investors make informed decisions. You can easily track your investments, monitor your portfolio performance, and get personalized investment recommendations based on your financial goals and risk tolerance.

Overall, Stash is a user-friendly and accessible investment platform that allows anyone to invest in their future, even those with a limited budget.

Robinhood

Robinhood is an investment platform that doesn’t charge any commission fee and allows users to trade various financial instruments like stocks, ETFs, options, and cryptocurrency. The service has a user-friendly interface, making it easy for both novice and experienced investors to use. Robinhood has fractional share purchasing, which lets you buy a portion of a share of stocks and ETFs. In other words, you can invest in companies with high stock prices without breaking the bank.

Robinhood also provides various educational resources like articles, videos, and more to help you learn about investment strategies, market trends, risk management, and more. This makes Robinhood an ideal platform for anyone who wants to learn about investing.

Fidelity Bloom

If you’re new to saving or investing, Fidelity Bloom is the perfect solution. The platform offers a user-friendly interface and many educational resources to help you learn about investing and financial management. You can easily set financial goals, monitor your expenses, and start saving for the future.

Fidelity Bloom has several unique features, such as nudges and challenges, designed to motivate you to save and spend money wisely. Nudges are personalized messages offering suggestions for improving your financial habits, while challenges are fun tasks encouraging you to save money or learn new financial concepts. The platform also incorporates behavioral science insights to help you make better financial decisions.

As a new Fidelity Bloom user, you can choose between two brokerage accounts: Save and Spend. You can quickly transfer funds between these accounts to help you achieve your saving goals.

Invstr

Invstr is an excellent app with tons of features to help people new to investing. It’s got a big community, educational materials, and even a game where you can pretend to trade stocks. This game is helpful because you can learn about investing without putting real money on the line.

Invstr has other resources like webinars, videos, and articles covering everything you need to know about investing and making it easy to learn and grow your knowledge.

And perhaps the most remarkable thing about Invstr is that it also has a community of people who are all into investing. You can talk to them and get ideas or share your own experiences. It’s like a community of people who want to help each other succeed in the stock market.

SoFi

SoFi is an excellent investment app that provides various features particularly suited for novice investors. One of the key features that makes it stand out is the built-in robot adviser that helps you create a customized investment portfolio based on your financial goals and risk appetite. This tool ensures you are well-equipped to make informed investment decisions that align with your needs and preferences.

SoFi’s social trading feature is another unique feature that offers a fantastic way to learn from other investors. The app enables you to follow other investors, observe their buying and selling activities, and even replicate their trades. This feature allows you to emulate the strategies of successful investors and potentially benefit from their expertise.

SoFi also provides a platform for sharing your investment ideas with others. This feature is handy for beginners who want to learn from others and get feedback on their investment ideas.

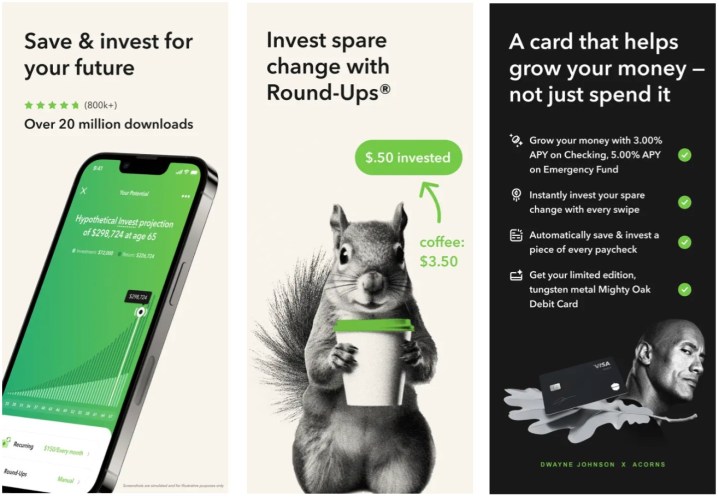

Acorns

Acorns could be your app if you’re new to investing and want to start small. It’s a micro-investing app that rounds up your purchases to the nearest dollar and invests the difference automatically. As such, you don’t have to worry about breaking the bank!

Getting started with Acorns is super easy and takes just a few minutes. All you need to do is link your bank account to the app, and you’re good to go. Acorns will start rounding up your purchases, and before you know it, you’ll have a small investment portfolio to call your own.

The app is very user-friendly and straightforward to navigate. You can set up recurring investments, keep an eye on your portfolio, and withdraw your funds anytime. The app offers investment advice and guidance to help you make informed decisions.

Public

If you want to learn more about investing, one of the best ways to do so is by interacting with experienced investors. This is where the Public app comes in handy. You can follow the investments of other investors to get insights into what they are buying, which can help you make better-informed decisions when trading on your own. Public offers a comprehensive list of educational resources, such as articles, videos, and more, to further support you.

Public is similar to other trading apps, allowing you to buy and sell various stocks, cryptocurrencies, ETFs, and more. You can also buy fractional shares, which lets you start investing for as little as $5.

Greenlight

Teaching children about investing is crucial, and the Greenlight app can help facilitate this learning process. While the app primarily serves as a savings and chore app, it also allows parents and kids to invest in stocks and other assets together. With thousands of stocks and ETFs available, users can access various investment options. The app’s fractional trading feature allows users to buy and sell stocks in small fractions, making it easy for children to get started with investing and saving money in general.

The app is affordable, and families can start investing with a low-cost membership. Overall, the Greenlight app is an excellent tool for teaching children about investing. It provides a user-friendly platform for families to collaborate on their investment journey, making the process accessible and straightforward.

Betterment

If you’re looking for an effortless and stress-free way to invest your money, you might consider using Betterment, a robo-adviser app that can help you achieve your financial goals. Betterment is a platform that combines advanced algorithms and human expertise to manage your portfolio and help you create a personalized investment plan tailored to your needs. With Betterment, you can quickly build a diversified portfolio that aligns with your risk tolerance, investment goals, and timeline.

Betterment’s user-friendly interface and intuitive design make investing simple and convenient. You can easily track your progress and monitor your investments from the comfort of your home or on the go. Betterment also offers fractional investing, meaning you can invest in various stocks and bonds with just a tiny amount of money. This makes it a perfect solution for people who are just starting to invest or don’t have a lot of disposable income.

Schwab Mobile

Schwab Mobile is an advanced and user-friendly application designed for stock trading. It was developed to provide its users with an exceptional trading experience that is both easy to use and efficient. The trusted name of Charles Schwab backs the app, and it features a comprehensive dashboard that provides real-time updates, breaking news, and price charts for easy analysis. With Schwab Mobile, users can easily trade stocks, ETFs, mutual funds, etc. The app also allows users to create custom watch lists to keep track of their favorite options and monitor their investments closely.

Schwab Mobile is also an excellent choice for new traders. The app provides access to various investing guides, videos, and podcasts, making it easier for beginners to learn about investing and make informed decisions.

Editors' Recommendations

- The 7 best voice-changing apps for Android and iOS in 2024

- The 5 best Bluetooth trackers for 2024

- The best piano apps in 2024: top apps for learning how to play

- The best folding phones in 2023: the 6 best you can buy

- The best Android phones in 2023: the 16 best ones you can buy

As an enthusiast with extensive knowledge in the field of investing and financial technology, I've been actively involved in the stock market, cryptocurrencies, and various investment platforms. I have hands-on experience using these apps and have gained a deep understanding of their features, advantages, and potential drawbacks. My goal is to provide valuable insights to help individuals make informed decisions about their investments.

Now, let's delve into the concepts mentioned in the article and provide additional information:

-

Stash:

- Overview: Stash is an innovative mobile application for investing in stocks, bonds, and ETFs.

- Key Features:

- Start investing with as little as $5 and purchase fractional shares.

- Stock-Back Card allows earning rewards on everyday spending, directing them towards your portfolio.

- Tools and resources for informed decision-making.

-

Robinhood:

- Overview: Robinhood is a commission-free investment platform for stocks, ETFs, options, and cryptocurrencies.

- Key Features:

- User-friendly interface with fractional share purchasing.

- Educational resources like articles and videos for learning about investment strategies.

- Ideal for both novice and experienced investors.

-

Fidelity Bloom:

- Overview: Fidelity Bloom is a platform for saving and investing, tailored for beginners.

- Key Features:

- User-friendly interface with educational resources.

- Nudges and challenges to motivate users in improving financial habits.

- Two brokerage accounts: Save and Spend.

-

Invstr:

- Overview: Invstr is an app designed for those new to investing, featuring a community, educational materials, and a stock-trading simulation game.

- Key Features:

- Community engagement for sharing experiences and ideas.

- Stock-trading game for learning without real financial risk.

- Webinars, videos, and articles covering various aspects of investing.

-

SoFi:

- Overview: SoFi is an investment app with features suitable for novice investors, including a robot adviser and social trading.

- Key Features:

- Customized investment portfolio creation with a built-in robot adviser.

- Social trading to observe and replicate the strategies of other investors.

- Platform for sharing investment ideas.

-

Acorns:

- Overview: Acorns is a micro-investing app that rounds up purchases to invest the spare change automatically.

- Key Features:

- Easy setup with automatic investment based on rounded-up purchases.

- User-friendly interface with investment advice and guidance.

- Recurring investments and portfolio monitoring.

-

Public:

- Overview: Public is a trading app that emphasizes learning from experienced investors by allowing users to follow their trades.

- Key Features:

- Follow and gain insights from other investors' activities.

- Comprehensive educational resources, including articles and videos.

- Ability to buy and sell various financial instruments.

-

Greenlight:

- Overview: Greenlight is a savings and chore app that also facilitates parent-child collaboration in investing.

- Key Features:

- Allows parents and kids to invest in stocks and other assets together.

- Fractional trading for easy entry into investing.

- Affordable with a user-friendly platform for family collaboration.

-

Betterment:

- Overview: Betterment is a robo-adviser app offering an effortless way to invest, combining advanced algorithms with human expertise.

- Key Features:

- Personalized investment plan creation based on financial goals and risk tolerance.

- User-friendly interface with fractional investing options.

- Stress-free portfolio management and progress tracking.

-

Schwab Mobile:

- Overview: Schwab Mobile is an advanced application designed for stock trading, backed by Charles Schwab.

- Key Features:

- Comprehensive dashboard with real-time updates, breaking news, and price charts.

- Access to investing guides, videos, and podcasts for education.

- Suitable for both advanced users and beginners.

In conclusion, these apps cater to various preferences and financial goals, offering a range of features from commission-free trading to educational resources and social trading capabilities. Choosing the right app depends on individual needs, risk tolerance, and desired features for a comprehensive investment experience.